Forever 21 initiates second bankruptcy in 6 years

Fast-fashion retailer Forever 21 faces another financial hurdle as mounting competition from foreign companies threatens its future in the retail landscape.

According to USA TODAY, F21 OpCo, Forever 21's operator, filed for Chapter 11 bankruptcy protection in Delaware on Sunday, marking its second bankruptcy filing in six years.

The company plans to maintain operations at its U.S. stores and website while searching for potential buyers. This development follows recent store closures across multiple states and the announcement of 358 layoffs at its Los Angeles headquarters.

Foreign competition drives retail giant downfall

Intense competition from international fast-fashion retailers, particularly Shein and Temu, has significantly impacted Forever 21's market position.

These foreign competitors leverage the de minimis exemption, allowing them to import items valued at $800 or less without duties, enabling them to offer substantially lower prices.

Jamie Salter, CEO of Authentic Brands, had previously acknowledged the mounting pressure from these competitors. During a conference last year, he revealed that their partnership with Shein in 2023 produced modest results at best.

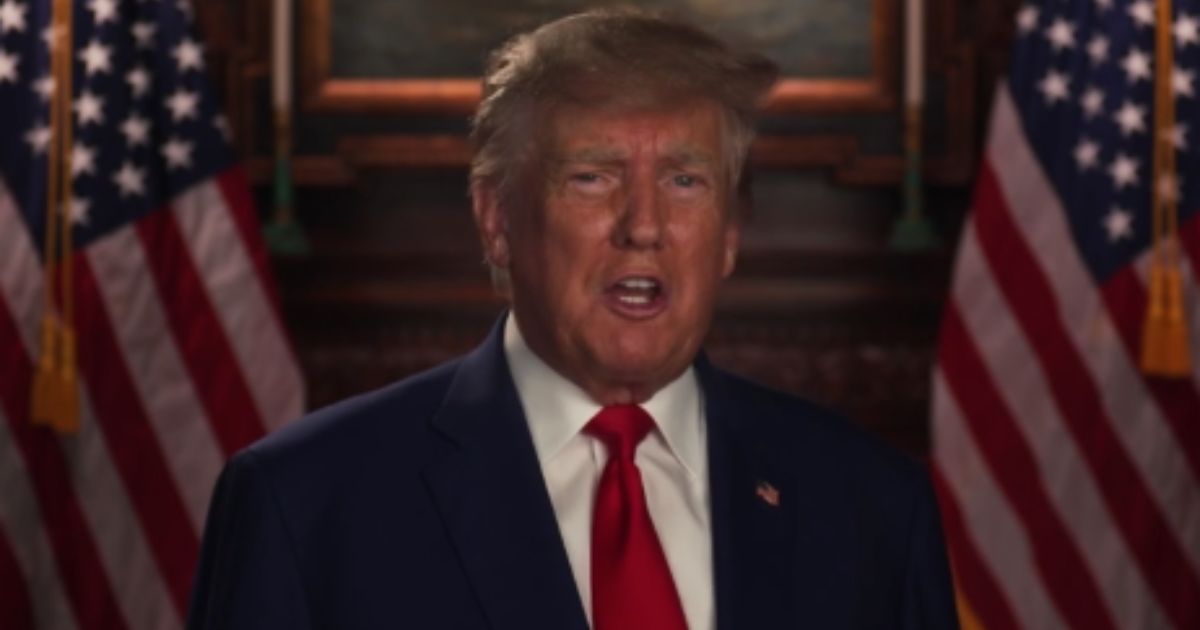

President Donald Trump's recent decision to halt his administration's repeal of the de minimis exemption has maintained these favorable conditions for Chinese online retailers, further challenging Forever 21's competitive position.

Strategic measures amid financial restructuring

Brad Sell, chief financial officer of F21 OpCo, explained the company's current situation:

While we have evaluated all options to best position the Company for the future, we have been unable to find a sustainable path forward, given competition from foreign fast fashion companies, which have been able to take advantage of the de minimis exemption to undercut our brand on pricing and margin, as well as rising costs, economic challenges impacting our core customers, and evolving consumer trends.

The retailer has already begun closing locations in Connecticut, California, Washington state, Pennsylvania, Idaho, and North Dakota.

Current operations continue with significant discounts, including up to 80% off sitewide and 70% off select styles.

Brand survival beyond retail operations

Authentic Brands Group, which owns Forever 21's brand and intellectual property, maintains an optimistic outlook despite the current challenges. Jarrod Weber, global president for lifestyle at Authentic Brands, shared his perspective:

Forever 21 is one of the most recognizable names in fast fashion. It is a global brand rooted in the U.S. with a strong future ahead. Retail is changing, and like many brands, Forever 21 is adapting to create the right balance across stores, e-commerce and wholesale.

The company plans to modernize its distribution model by implementing a direct creation-to-shelf approach. This strategy aims to accelerate production cycles and optimize pricing competitiveness.

Moving forward through transformation

Sarah Foss, head of legal at Debtwire and an expert bankruptcy lawyer, emphasizes that store closures do not signal the end of Forever 21.

The brand's intellectual property and international business remain unaffected by the U.S. licensee's restructuring.

Authentic Brands has reported significant interest from brand operators and digital experts in implementing their new strategy. The company remains focused on maintaining Forever 21's position as a leading fast-fashion retailer through strategic adaptations.

Final chapter unfolds in retail saga

F21 OpCo's second bankruptcy filing within six years represents a critical moment for the once-dominant fast-fashion retailer. The combination of fierce competition from foreign companies and evolving market dynamics has forced the company to seek bankruptcy protection while exploring potential buyers.

The future of Forever 21 now depends on Authentic Brands Group's ability to modernize its operations and adapt to changing consumer preferences.

While U.S. store closures loom on the horizon, the brand's intellectual property and international presence suggest potential for renewal under new ownership and strategic direction.