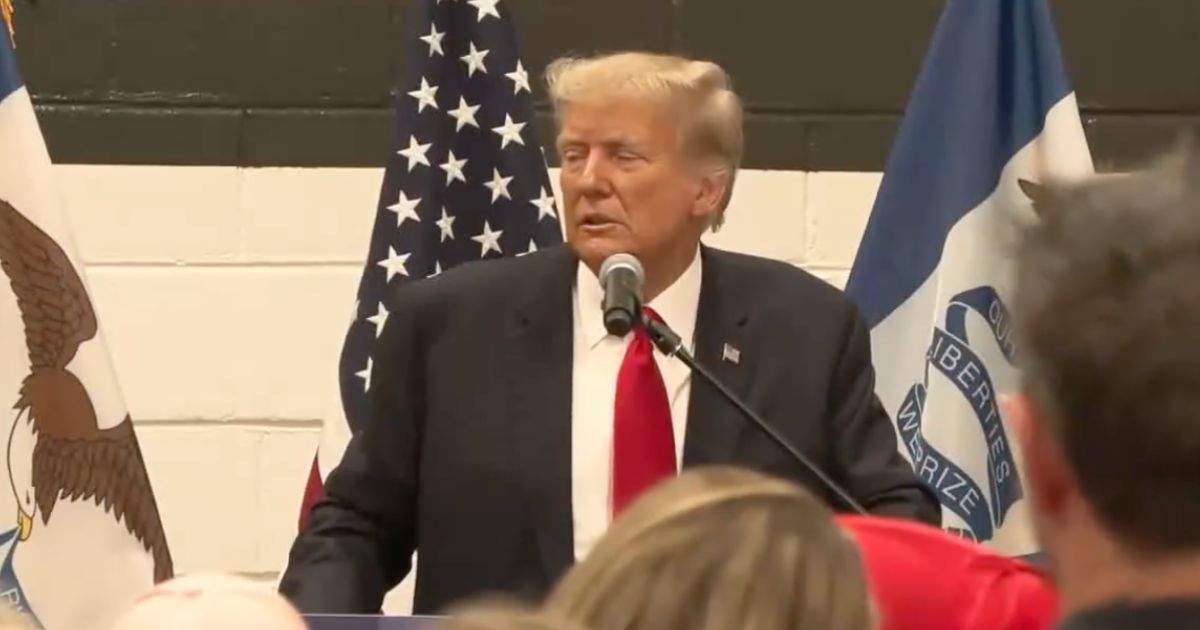

Trump files $10 billion lawsuit against IRS, Treasury over tax leaks

President Donald Trump has launched a staggering legal battle against the federal government, targeting the IRS and Treasury Department with a lawsuit demanding at least $10 billion in damages.

Filed on Thursday, the suit claims that Trump’s confidential tax information was unlawfully disclosed in 2019, leading to significant harm. The plaintiffs, including Donald Trump Jr., Eric Trump, and the Trump Organization, assert that the breach resulted in reputational damage, financial loss, and public embarrassment. The case ties back to the actions of a former IRS contractor, Charles Littlejohn, who was sentenced to five years in prison in January 2024 after pleading guilty to leaking 15 years of Trump’s tax records to The New York Times and ProPublica.

The issue has sparked intense debate over government accountability and the protection of private citizen data, even for high-profile figures like Trump. Many argue that this case highlights a broader problem of overreach and negligence within federal agencies. Let’s unpack how this unfolded and why it matters to everyday Americans who value privacy.

Tax Records Leaked in 2019 Scandal

Back in 2019, Trump’s tax information was exposed in a breach that rocked public trust in the IRS. The leaked records, published by The New York Times in September 2020, revealed that Trump paid just $750 in federal income taxes for both 2016 and 2017.

These figures ignited a firestorm of criticism, with articles alleging questionable tax practices. The lawsuit, however, contends that much of the published content included false information, damaging the Trump family’s public standing. It’s hard to ignore how selective leaks can paint a distorted picture when taken out of context.

Charles Littlejohn, the contractor behind the leak, admitted guilt and now sits behind bars for his actions. But for many, a five-year sentence feels like a slap on the wrist when weighed against the fallout for the Trumps. Shouldn’t the government bear more responsibility for failing to safeguard such sensitive data?

Trump’s Legal Fight for Accountability

Daily Caller reports that Trump isn’t holding back, and this $10 billion claim sends a clear message: no one is above accountability, not even the IRS. The suit alleges a direct breach of duty by the agency in protecting confidential returns from unauthorized release. If proven, this could set a precedent for how taxpayer information is handled moving forward.

Adding fuel to the fire, Trump himself weighed in on the issue years ago. “The Fake News Media, just like Election time 2016, is bringing up my Taxes & all sorts of other nonsense with illegally obtained information & only bad intent,” he posted on September 28, 2020.

That statement cuts to the core of a lingering distrust many Americans feel toward both media and government institutions. When private data is weaponized, it’s not just a personal attack—it erodes faith in the system itself. Whose next if even a former president’s records aren’t safe?

Broader Pattern of Government Disputes

This isn’t Trump’s first rodeo with federal agencies, either. According to The Washington Post, he’s filed two other damage claims against the government—one in 2023 over issues tied to the Russia investigation and another in 2024 concerning the FBI’s raid on Mar-a-Lago. This pattern suggests a deeper frustration with perceived overreach.

For many supporters, these legal battles underscore a critical need to rein in bureaucratic power. Agencies like the IRS and FBI shouldn’t operate as unchecked entities, especially when their actions impact private citizens, no matter their status. It’s a principle worth fighting for, isn’t it?

The involvement of Donald Trump Jr., Eric Trump, and the Trump Organization in this lawsuit amplifies its scope. They, too, claim to have suffered from the fallout of the 2019 leak. This isn’t just one man’s grievance—it’s a family and business standing up against what they see as a grave injustice.

Privacy Concerns for All Americans

At its heart, this case transcends politics and strikes at a universal concern: privacy. If the IRS can’t protect a high-profile figure’s data, what hope do regular folks have against similar breaches? The ripple effects of this scandal could haunt taxpayers for years.

While some may cheer the exposure of Trump’s low tax payments, others see a dangerous precedent in government negligence. Public embarrassment and financial harm aren’t abstract concepts—they hit real people, whether they’re billionaires or blue-collar workers. We should all demand better from the institutions meant to serve us.

As this lawsuit unfolds, it’s a reminder that accountability must cut both ways. The government isn’t above scrutiny, and neither should it be. Let’s hope this case sparks real reform, not just headlines, for the sake of every American’s right to privacy.